Texas Infrastructure Investment: 2026 Report

Texas Infrastructure Investment: 2026 Report

our research team analyzed the most comprehensive dataset to date on Texas infrastructure investment and spending across transportation, water, energy, and digital sectors. This 2026 edition reflects the most recent state and federal commitments entering the 2026 planning cycle, drawing from official state budget documents, federal allocations, and long-range infrastructure assessments.

Our findings highlight both historic capital deployment, most notably $148 billion committed to transportation, and persistent long-term funding gaps, particularly in water and utility infrastructure. Together, these trends define the capital landscape shaping Texas’s growth trajectory through mid-century.

Texas Infrastructure Investment by Major Region (2024–2030)

Infrastructure investment across Texas continues to vary significantly by region. Major metropolitan areas dominate total funding allocations, while rural and energy-producing regions focus on essential services, resilience, and connectivity.

| Region | Total Investment | % of Total | Primary Focus Areas | Major Projects |

|---|---|---|---|---|

| DFW Metroplex | $47 billion | 28.3% | Highway expansion, transit, utilities | I-35 corridor, DFW airport, water systems |

| Houston Metro | $38 billion | 22.9% | Port, petrochemical, flood control | Hurricane infrastructure, I-45, ship channel |

| Austin–San Antonio Corridor | $31 billion | 18.7% | Population growth, tech infrastructure | I-35 expansion, broadband, water supply |

| East Texas | $18 billion | 10.8% | Energy infrastructure, rural roads | Pipeline projects, rural broadband, bridges |

| Border Regions (Rio Grande Valley) | $15 billion | 9.0% | Trade infrastructure, water projects | Border crossings, colonias water, highways |

| West Texas (Permian Basin) | $12 billion | 7.2% | Energy grid, pipeline infrastructure | Oil/gas facilities, rural connectivity |

| Central Texas | $5 billion | 3.0% | Rural connectivity, agriculture support | Farm-to-market roads, water systems |

| Total Statewide | $166 billion | 100% | Multi-sector development | All major categories |

Source: Analysis of TxDOT regional allocations, metropolitan planning organizations, and Texas Water Development Board regional plans.

The DFW Metroplex, Houston, and the Austin–San Antonio corridor continue to account for nearly 70% of statewide infrastructure spending in 2026, reflecting population density, economic output, and congestion pressures. Rural regions, while receiving smaller absolute allocations, maintain higher per-capita investment in water, energy, and broadband infrastructure.

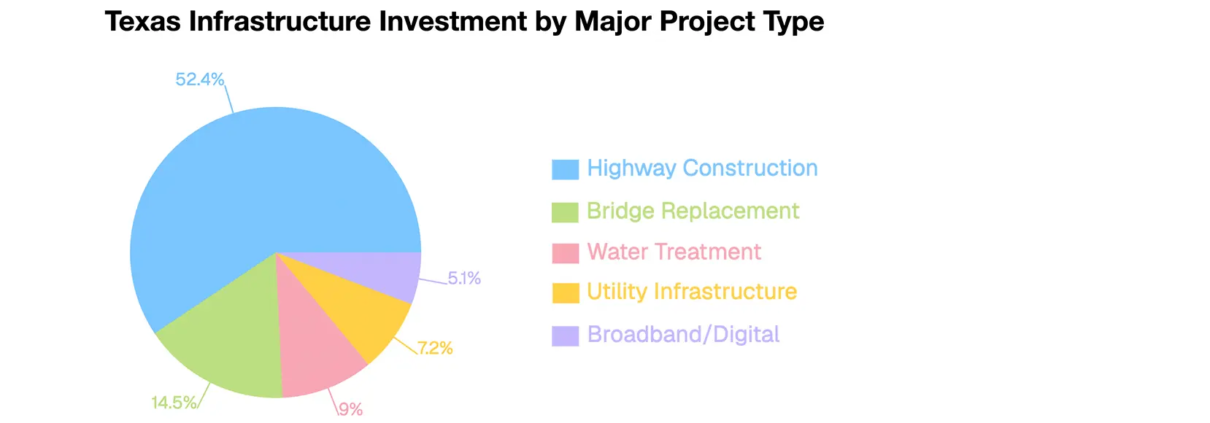

Texas Infrastructure Investment by Project Type (2024-2030)

Texas infrastructure funding remains heavily concentrated in transportation, though water, utilities, and broadband investments continue to expand as strategic priorities entering 2026.

| Project Type | Total Investment | % of Total | Primary Funding Source | Timeline |

|---|---|---|---|---|

| Highway Construction & Expansion | $87 billion | 52.4% | State Highway Fund | 2024–2034 |

| Bridge Replacement & Repair | $24 billion | 14.5% | State/Federal Bridge Programs | 2024–2035 |

| Water Treatment & Distribution | $15 billion | 9.0% | Water Fund, Federal IIJA | 2025–2047 |

| Utility Infrastructure Upgrades | $12 billion | 7.2% | Municipal Bonds, Private | 2024–2030 |

| Broadband/Digital Infrastructure | $8.5 billion | 5.1% | Federal BEAD, State BIF | 2024–2028 |

| Airport & Aviation Projects | $6 billion | 3.6% | FAA, State Aviation Fund | 2024–2027 |

| Wastewater & Sewer Systems | $5 billion | 3.0% | State Water Fund | 2025–2035 |

| Emergency Infrastructure Repairs | $4 billion | 2.4% | Emergency Funds | Ongoing |

| Public Transit Projects | $3.5 billion | 2.1% | Federal Transit Admin | 2024–2030 |

| Energy Grid Improvements | $1 billion | 0.6% | Texas Energy Fund | 2025–2028 |

| Total Major Projects | $166 billion | 100% | Multiple Sources | 2024–2047 |

Note: Highways and bridges represent nearly 67% of total investment. Texas committed a record $148 billion to transportation in 2024, including $1.9 billion in new Clear Lanes funding for congestion relief. Most of this investment is supported by Propositions 1 and 7, which redirect oil, gas, and motor-vehicle sales taxes to the State Highway Fund, generating about $4.7 billion annually.

Texas Commits Record $148 Billion to Transportation Infrastructure

Texas set a historic benchmark in 2024 when Texas Department of Transportation (TxDOT) announced a $148 billion transportation investment program extending through 2034. As of 2026, this funding remains the backbone of the state’s infrastructure pipeline.

| Investment Category | Amount (Billions) | % of Total | Purpose |

|---|---|---|---|

| 10-Year Transportation Plan | $104.0 | 70.3% | New highway construction and congestion relief |

| Development & Routine Maintenance | $43.0 | 29.1% | Infrastructure preservation and repairs |

| Additional Safety Initiatives | $17.3 | 11.7% | Rural and corridor safety projects |

| Clear Lanes Congestion Relief | $75.8 | 51.2% | Non-tolled projects since 2015 (overlapping category) |

Notes: Some categories overlap as projects serve multiple purposes. The $1.9B represents new funding added to the existing Clear Lanes program, which is part of the broader $104B construction category.

Source: Texas Governor’s Office; TxDOT 2024 Unified Transportation Program.

Water Infrastructure Crisis: $154 Billion Investment Gap

Despite transportation dominance, water infrastructure remains Texas’s most significant unresolved challenge entering 2026. According to Texas 2036, the state requires $154 billion in water-related investment.

In May 2025, lawmakers approved a $20 billion long-term water plan via Senate Bill 7 and HJR 7. While meaningful, the funding addresses only a fraction of projected needs.

| Infrastructure Need Category | Required Investment | Current Funding Commitment | Funding Gap |

|---|---|---|---|

| Water Supply Projects | $59 billion | $10 billion (50% of $20B plan) | $49 billion |

| Leaky Pipes & Maintenance | $74 billion | $10 billion (50% of $20B plan) | $64 billion |

| Wastewater Systems Repair | $21 billion | $2.5 billion (one-time) | $18.5 billion |

| Total Water Infrastructure | $154 billion | $22.5 billion | $131.5 billion |

The approved plan allocates $1 billion annually from 2027 through 2047, covering just 15% of identified needs. With Texas’s population projected to reach 53.2 million by 2080, infrastructure experts describe the current funding as merely a “down payment” on the state’s water crisis.

Underground Utility Infrastructure Drives Regional Economic Impact

For excavation and underground utility contractors like Kitching & Co, the infrastructure investment surge creates significant business opportunities, particularly in the Dallas–Fort Worth region where the company operates. The combination of transportation, water, and utility infrastructure projects generates substantial demand for specialized excavation services.

| Project Type | Estimated Value | Excavation/Utility Component | Timeline | Regional Impact |

|---|---|---|---|---|

| TxDOT Highway Projects (DFW) | $25 billion | 15–20% ($3.75–5B) | 2024–2034 | Direct contractor opportunities |

| Municipal Water Systems | $8 billion | 40–50% ($3.2–4B) | 2025–2035 | Underground utility work |

| Broadband Infrastructure | $500 million | 60–70% ($300–350M) | 2024–2028 | Trenching, conduit installation |

| Private Development | $15 billion | 25–30% ($3.75–4.5B) | Ongoing | Site preparation, utilities |

| Total Regional Pipeline | $48.5 billion | $11–14 billion | 6–10 years | Sustained demand growth |

Excavation and underground utility scopes consistently represent 20–50% of major infrastructure project value, creating an $11–14 billion addressable market in North Texas alone through the mid-2030s.

Requesting a Copy of This Report

This 2026 Texas Infrastructure Investment Report reflects ongoing analysis of the state’s unprecedented capital commitments and unresolved funding gaps. For excavation and underground utility contractors, Texas’s infrastructure pipeline represents one of the largest sustained opportunity environments in the U.S.

If you’d like to request a PDF copy of this report or learn more about our agency, you can reach out here.

Sources

- Governor Abbott, TxDOT Announce Record $148 Billion Transportation Investment. Office of the Texas Governor. August 27, 2024.

- Lawmakers near deal to spend $20 billion over two decades on water crisis. The Texas Tribune. May 27, 2025.

- 2025 Texas Infrastructure Report Card. American Society of Civil Engineers Texas Section. 2025.

- Building Strong Infrastructure for a Growing Texas. Texas Comptroller of Public Accounts. September 2023.

- Texas 2036 Water Infrastructure Report. Texas 2036. 2025.

- Infrastructure Investment and Jobs Act Allocations. White House Fact Sheets. 2021–2024.

Leave a Reply

Want to join the discussion?Feel free to contribute!